indiana estate tax return

93 Little Deer Creek Road. The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if.

Indiana Estate Tax Everything You Need To Know Smartasset

Take a look at the table below.

. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of. Starting in 2023 it will be a 12 fixed rate. The state income tax rate is 323 and the sales tax rate.

5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706. Pay my tax bill in installments. Know when I will receive my tax refund.

Date of death 4. Report the tax due on Employers Withholding Tax Return submit withholding the Indiana portion of income from an Electing Small Business Trust ESBT on Line 11 of the IT-41 return. Your maximum refund guaranteed.

If you wish to check for billing information be sure to have a copy of your tax. For more information please join us for an upcoming FREE seminar. Tax payments on behalf of all nonresident beneficiaries.

All district offices have hours from 8 am. A federal estate tax return will be required only if the deceased persons taxable estate is very largefor deaths in 2022 more than 1206 million. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan.

Department of the Treasury. Ad Explore state tax forms and filing options with TaxAct. EARNED INCOME LOCAL SERVICES TAX COLLECTOR.

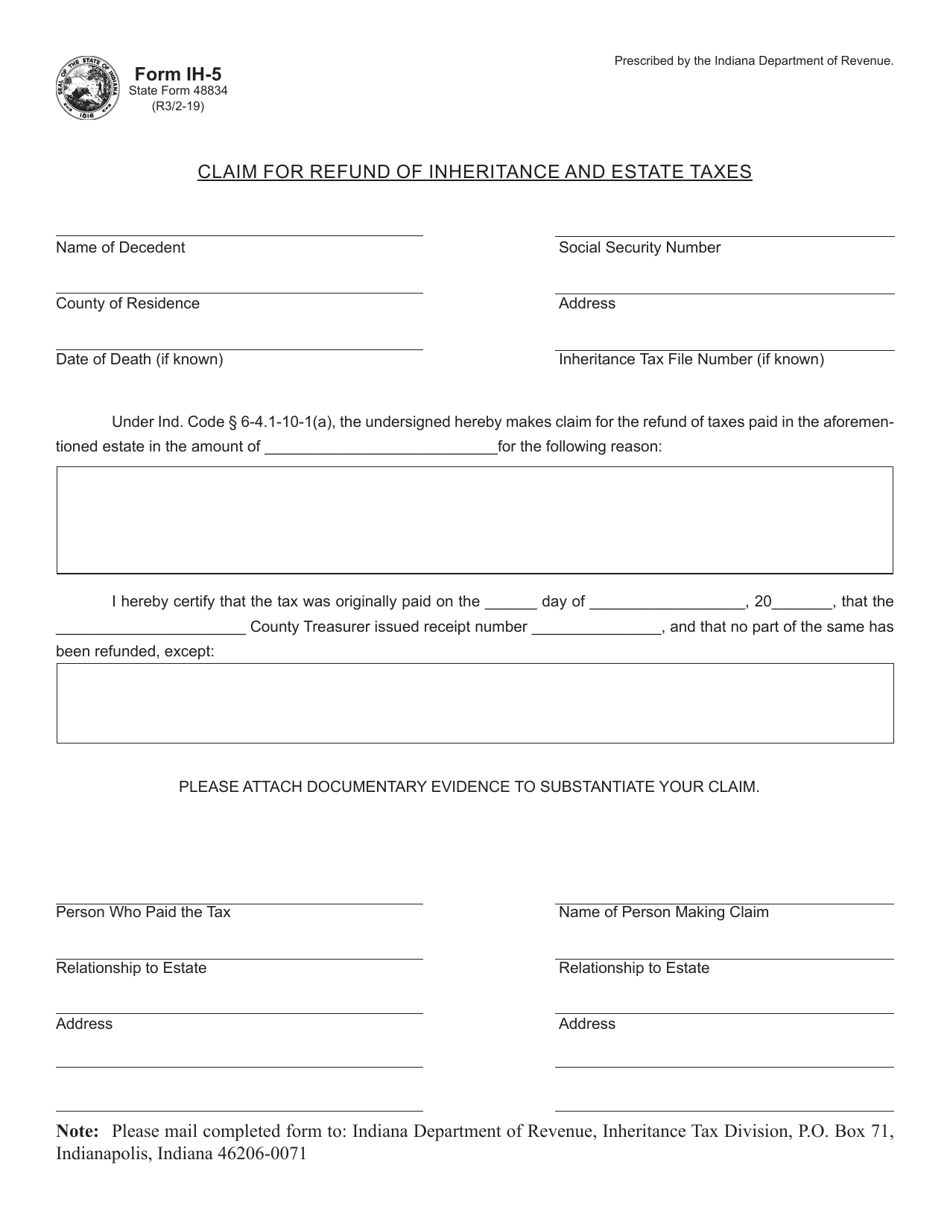

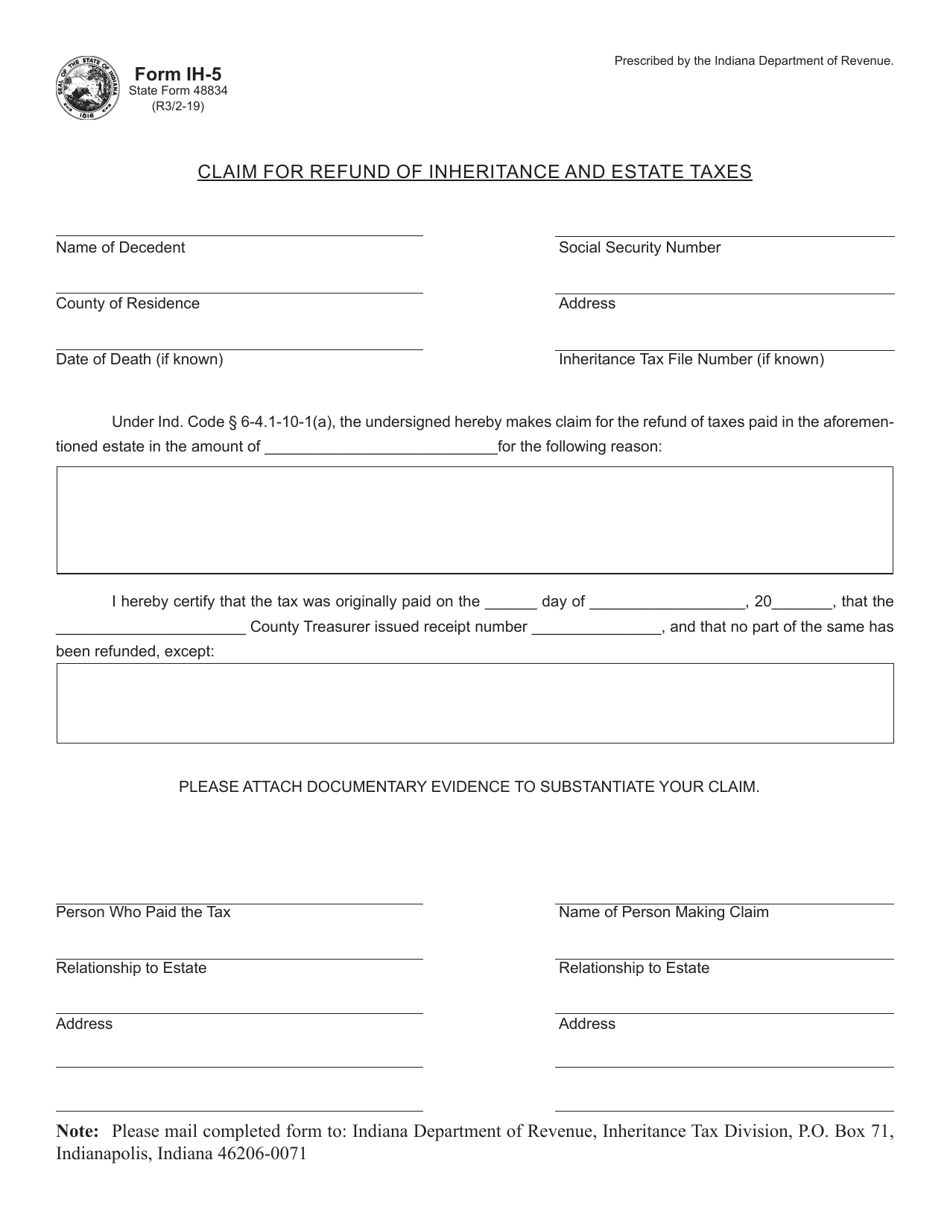

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Indiana allows the same amount of time granted by the IRS plus 30 days. Up to 25 cash back These returns are generally due by April 15 of the year following the year of death.

All district offices in Indiana have access to copies of. 4 On a monthly or quarterly basis using Form WH-1 if any and attached to the return. More than 999 of all estates do not owe.

Income Tax Return for Estates and Trusts. 2022 Millage rate is 201269 mills or 201269 per 10000 valuation. To 430 pm Monday through Friday with the exception of major holidays.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. If you have additional questions or concerns about estate planning and taxes contact an experienced Indianapolis estate planning attorney at Frank Kraft by calling 317 684-1100 to schedule an appointment. The tax rate ranges from 116 to 12 for 2022.

The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. Extension form to Form IT-41 when you file the return. Of the estate or trust.

Of all the states Connecticut has the highest exemption amount of 91 million. Taxpayer as shown on Form 1041 US. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Find Indiana tax forms. Find Indiana tax forms.

The deceased was under the age of 65 and had adjusted gross income more than 1000. Claim a gambling loss on my Indiana return. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment. Business or occupation 3. Decedents residence domicile at time of death 5.

The deceased was a nonresident and had any income from Indiana. Indiana Department of Revenue. More information can be found in our Inheritance Tax FAQs.

4810 for Form 709 gift tax only. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note. Take the renters deduction.

Ad Edit Sign or Email IRS 706 More Fillable Forms Register and Subscribe Now. Looking to file your state tax return. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Pay my tax bill in installments. Inheritance tax was repealed for individuals dying after Dec. Contact a district office of the Indiana Department of Revenue see Resources.

Contact an Indianapolis Estate Planning Attorney. Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits long-term care planning probate with trust administration and probate avoidance. The deceased was age 65 or older and had adjusted gross income more than 2000.

If you are filing a fiscal-year return please enter the beginning and ending period dates in the fiscal year boxes MMDDYYYY. 430 pm EST or via our mailing address. The estate tax rate is based on the value of the decedents entire taxable estate.

Claim a gambling loss on my Indiana return. Have more time to file my taxes and I think I will owe the Department. If you are filing a calendar-year return please enter the 4-digit tax year in the box YYYY.

Income tax returns may also be required for the estate itself. Know when I will receive my tax refund. The income that is either accumulated or.

Please read carefully the general instructions before preparing this return. Have more time to file my taxes and I think I will owe the Department. This tax return is used by the fiduciary representative to report the income deductions gains losses etc.

Social Security number 6. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. TaxAct can help file your state return with ease.

Planning 2014s Taxes with Your 2013 Tax Return. Your W-2s 1099s and a copy of last years state and federal tax returns. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Information Line Call the information line at 317 232-2240 to get the status of your refund billing and payment plan information a copy of your tax return or prerecorded tax topics. No tax has to be paid. REAL ESTATE TAX COLLECTOR Township and School Taxes Julie Leventry.

Take the renters deduction. Individual trust guardian or estate. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

2021 Estate Income Tax Calculator Rates

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Indiana Inheritance Laws What You Should Know Smartasset

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Who Must File Estate Tax Return When Internal Revenue Code Simplified

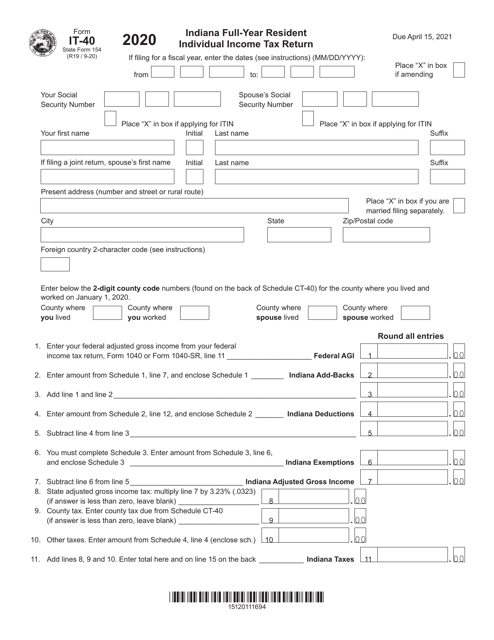

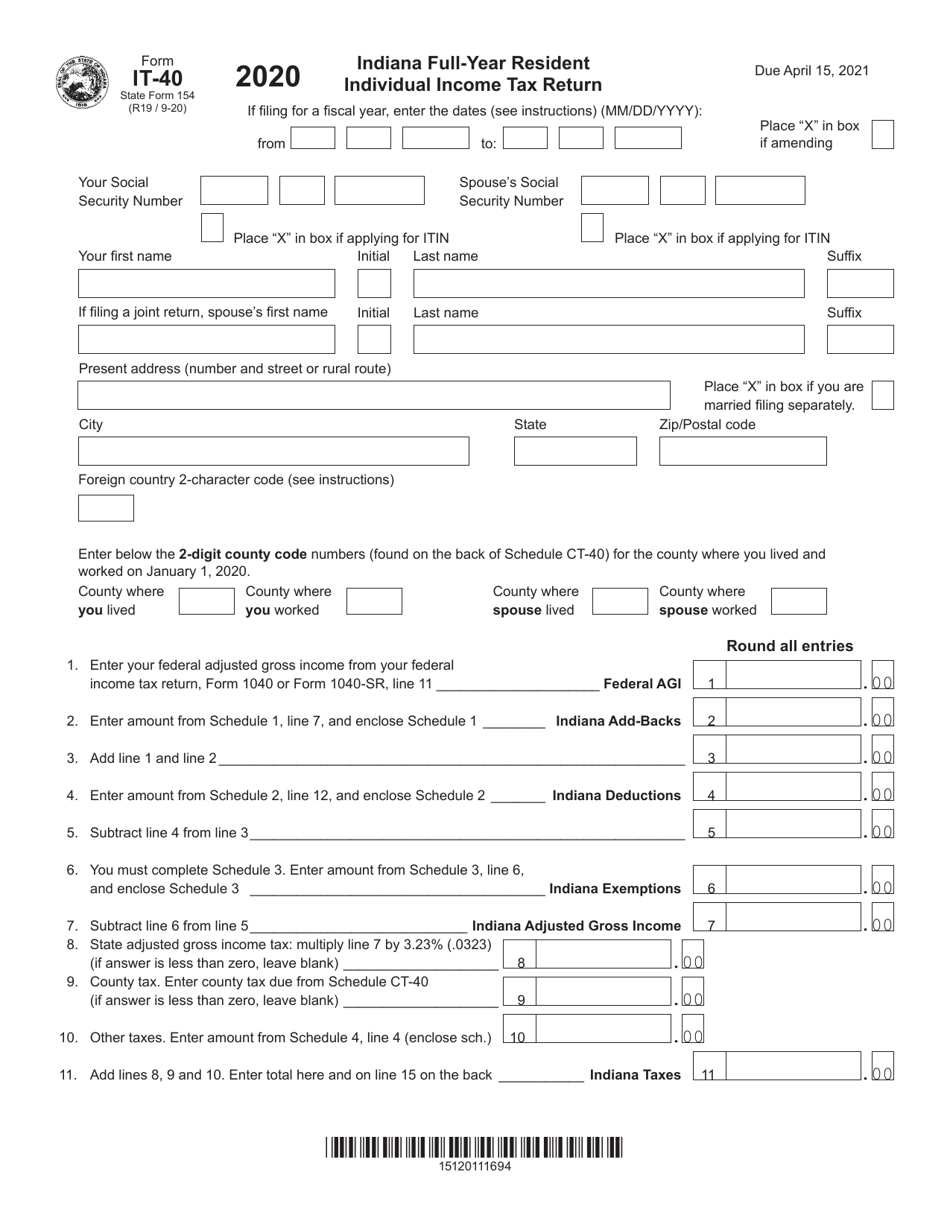

Form It 40 State Form 154 Download Fillable Pdf Or Fill Online Indiana Full Year Resident Individual Income Tax Return 2020 Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

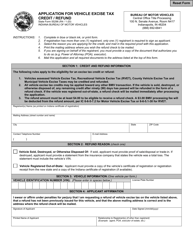

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

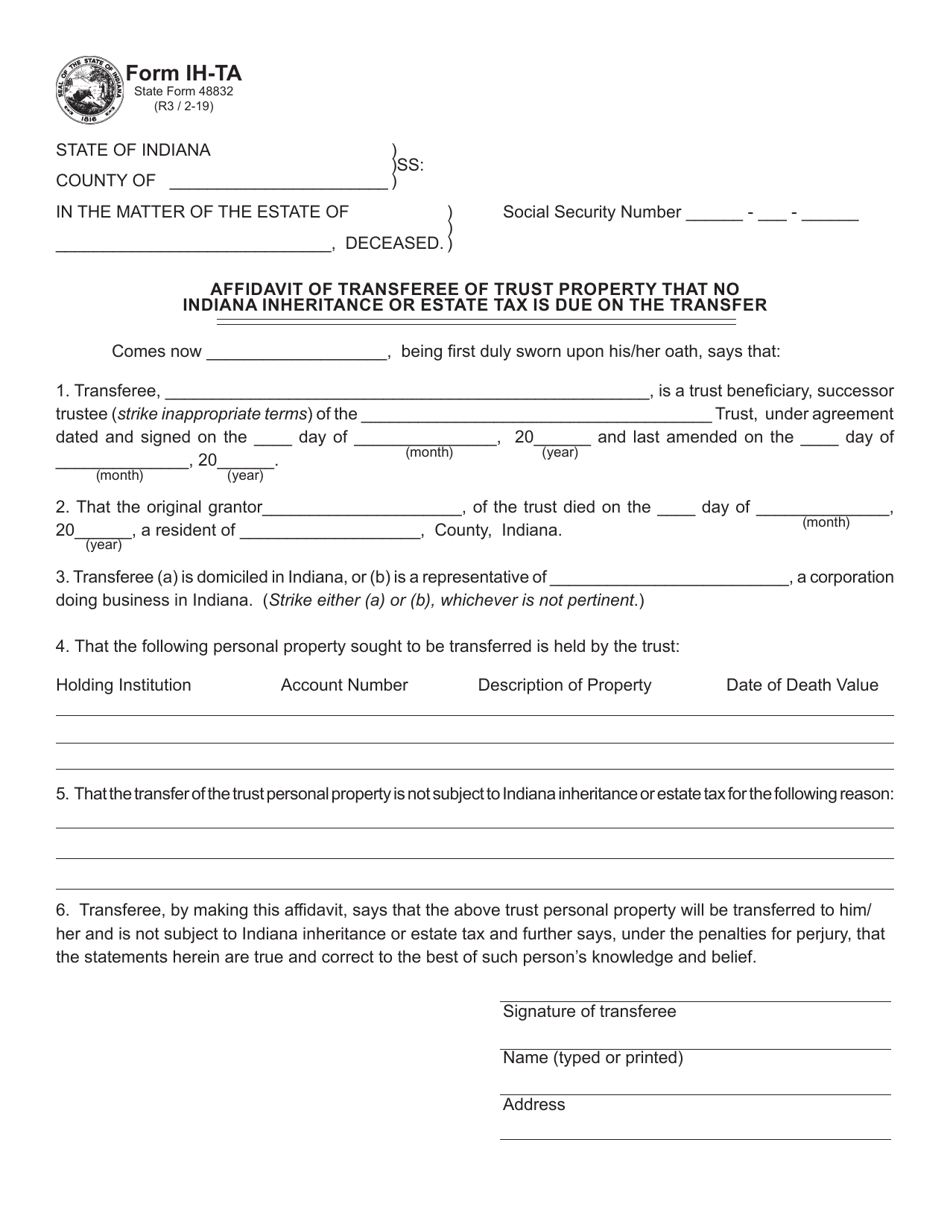

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Indiana State Taxes For 2022 Tax Season Forbes Advisor

Indiana Estate Tax Everything You Need To Know Smartasset

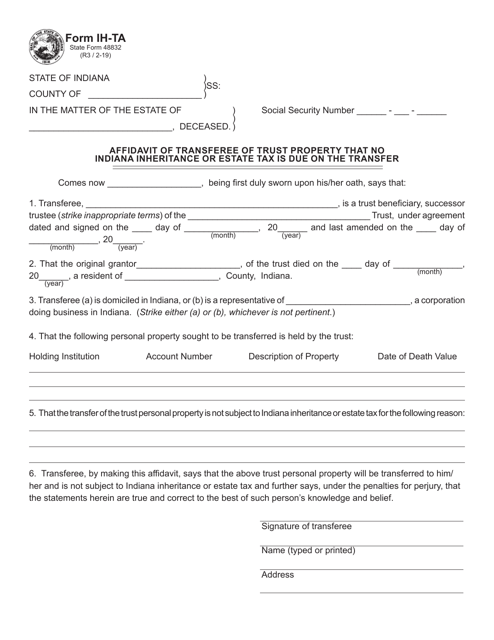

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Form It 40 State Form 154 Download Fillable Pdf Or Fill Online Indiana Full Year Resident Individual Income Tax Return 2020 Indiana Templateroller

Indiana State Tax Information Support

Indiana S 125 Automatic Tax Refunds To Begin Going Out In Next Few Weeks